The Black Swans of Nassim Nicholas Taleb

/From IT Conversations:

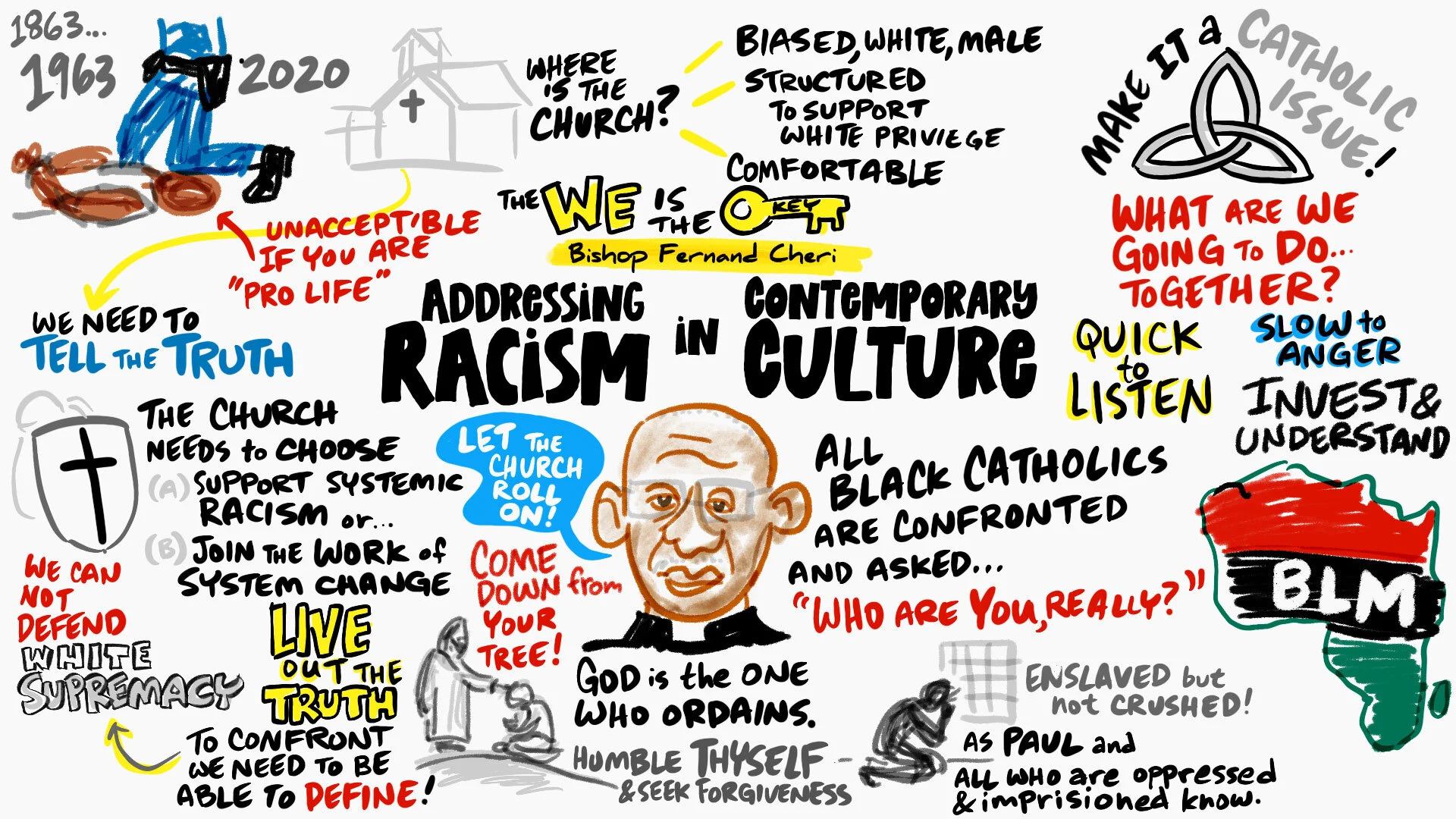

The hardest part of predicting the future is that it's, well, the future. That may sound flippant, but it's essentially true; the greatest problem in forecasting isn't understanding the current situation or the problem itself, it's accounting for unforeseen factors the cannot be predicted. In a session from Pop!Tech 2005, essayist and former financial trader Nassim Nicholas Taleb discusses these "black swans" and their effect on the task of forecasting.The complexity of the world increases each day, and our inability to forecast events increases as well. "Black swans", unforeseen and unforeseeable events, are impossible to predict but can drastically change results.

These essentially random factors cannot be accounted for, so how can we successfully forecast; how can we account for the unaccountable? Should we just stop forecasting altogether? Not according to Nassim Taleb; he details the pitfalls we encounter while trying to predict the future and a partial solution to the problem.

Peter Durand created this large scale illustration during, Taleb's talk at the What Do We Know session at Pop!Tech. The other speaker in this session was Robert Trivers. The question and answer period can be heard at the end of Robert Trivers' talk.

Nassim Nicholas Taleb is an essayist principally concerned with the problems of uncertainty and knowledge. Nassim's interests lie at the intersection of philosophy, mathematics, finance, literature and cognitive science, but he has stayed extremely close to the ground, thanks to an uninterrupted two-decade career as a mathematical trader. He held senior trading positions in New York and London, before founding Empirica LLC, a trading firm and risk research laboratory.

Nassim Nicholas Taleb is an essayist principally concerned with the problems of uncertainty and knowledge. Nassim's interests lie at the intersection of philosophy, mathematics, finance, literature and cognitive science, but he has stayed extremely close to the ground, thanks to an uninterrupted two-decade career as a mathematical trader. He held senior trading positions in New York and London, before founding Empirica LLC, a trading firm and risk research laboratory.

click for large view | buy prints & cards

He is the author of Dynamic Hedging and Fooled by Randomness, which has been published in 14 languages. Nassim's ideas on skeptical empiricism have been covered by hundreds of articles around the world.